The Ayala Way Vol. 4 No. 105

Globe Posts Record Revenues at P121.1B

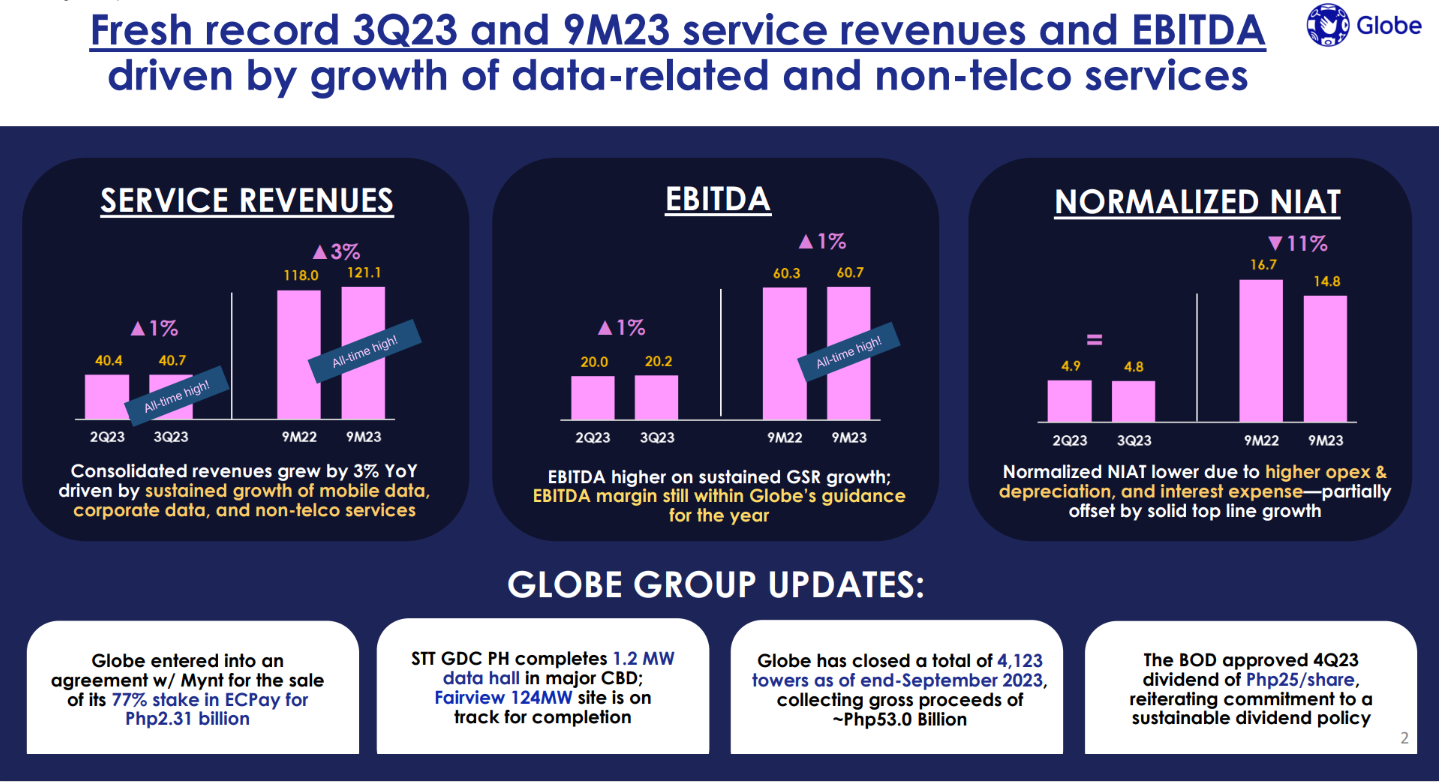

The Globe Group closed the first nine months of 2023 with all-time high consolidated service revenues amounting to P121.1 billion, up by 3 percent from a year ago despite the extended macroeconomic headwinds faced by the industry. This remarkable performance was mainly fueled by the strong contributions from its mobile, corporate data, and non-telco services, which fully offset the anticipated decline in home broadband. Globe’s non-telco services now accounts for 3.4 percent of its total consolidated service revenues from 2.4 percent last year. Additionally, total data revenues for the nine-month period stood at P99.6 billion, representing 82 percent revenue contribution to Globe’s topline from 81 percent in the previous year.

Our third quarter results show that our telecom business performance is very much aligned to the guidance we have set. On the other hand, our pivot to a techco business is showing signs of momentum. We are happy that more of the non-telco businesses are contributing to the Group's overall business growth and resilience.

ERNEST L. CU

Globe President and CEO

Globe's transformation from telco to techco has led it to diversify its portfolio with greater emphasis on digital solutions. As of end-September, the company’s non-telco revenues continued to post very strong growth with 44 percent increase at P4.1 billion from P2.8 billion in the same period last year. This stellar performance was brought about by the improved revenues across Globe subsidiaries led by ECPay, Adspark, Asticom, and Yondu.

For the first nine months this year, the Globe Group’s consolidated EBITDA reached a record P60.7 billion, up by 1 percent year on year, as the 3 percent topline expansion was partly cushioned by the 5 percent increase in operating expenses (including subsidy). EBITDA margin, which stood at 50 percent this period, remains within Globe’s guidance for the year.

Net income, however, dropped by 27 percent against the same period last year, mainly due to the increased depreciation expense as well as this period’s non-operating charges versus last year’s non-operating income which included the partial sale of Globe’s data center business. Excluding this one-time gain, normalized net income would have been P14.8 billion, down by 11 percent year on year. Accordingly, core net income, which excludes the impact of nonrecurring charges, and foreign exchange and mark-to-market charges, closed at P14.8 billion for the period or down by 8 percent versus the same period last year.

Globe’s balance sheet remains healthy and gearing comfortably within bank covenants despite the increase in debt from P233.2 billion as of end-2022 to P245.5 billion this period. Globe’s gross debt to EBITDA is at 2.62x while net debt to EBITDA is 2.46x; debt service coverage ratio is at 3.56x.

About the author

Knowledge Management (1)

AC Knowledge Management is responsible for enterprise content management, archives management, and the development of knowledge products and services in Ayala. KM produces books on corporate history and business developments and publishes the groupwide internal communications channel, The Ayala Way.