The Ayala Way Vol. 5 No. 22

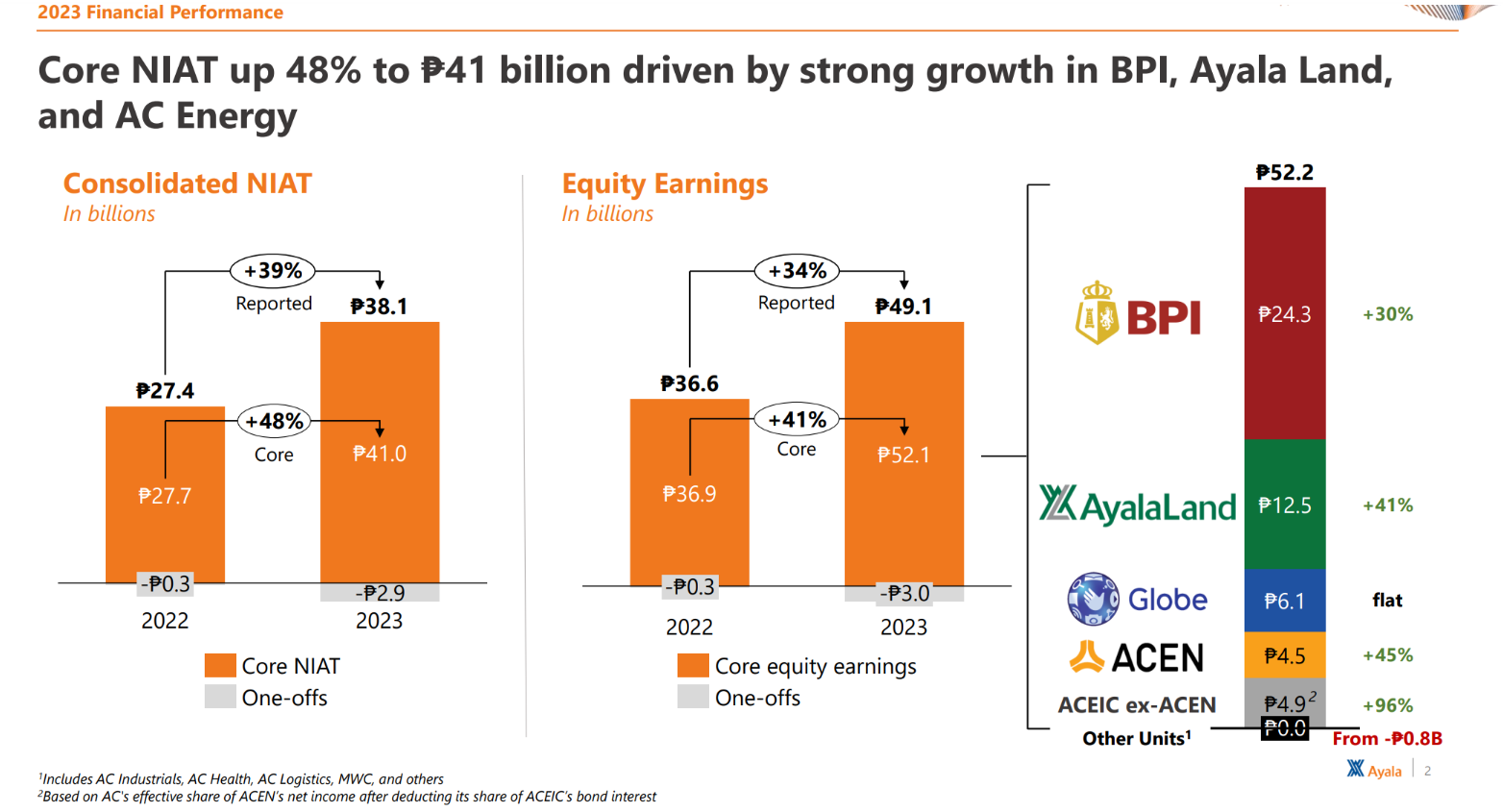

Ayala’s Core Profit Up 48% to P41 Billion in FY23

ACEN Records P7.4 Billion Net Income in 2023

ACEN reported net income of P7.4 billion for 2023. This represents a decline of 43 percent from 2022, which included P8.6 billion in accounting adjustments from various events in that period. Taking out the impact of all noncash items, ACEN’s profitability increased 150 percent year over year, driven by a nearly three-fold increase in core operating earnings.

As of end-2023, ACEN now carries over 4.7 GW in attributable capacity, 99 percent of which is from renewables. Of this, 37 percent is fully operational, 28 percent is partially operating, and 35 percent remains under construction.

Ayala Corporation’s core net income, which excludes one-off items, reached a new high water mark in 2023, increasing by 48 percent to P41 billion. The strong performance of BPI, Ayala Land, and AC Energy anchored the company’s results. Core net income was 32 percent higher than in 2019. Accounting for one-off gains, Ayala’s net income grew by 39 percent to P38.1 billion.

Said Ayala President and CEO Cezar P. Consing: “We succeeded in getting aggregate core earnings to exceed the pre-pandemic high. Now we focus on getting better operating and financial results from each of our businesses, and on rationalizing the portfolio where it makes sense to do so.”

Group capital expenditure reached P247.7 billion, 12 percent lower, mainly due to the tapering CAPEX of Globe. Parent CAPEX decreased by 55 percent to P13.2 billion.

Ayala continues to maintain a strong balance sheet with sufficient liquidity and low cost of debt. Consolidated cash stood at P76.2 billion while consolidated net debt increased eight percent to P513.6 billion. Consolidated net debt-to-equity ratio decreased by four basis points to 0.76, well within the company’s covenant of 3.0x. Parent-level cash was up five percent to P11.7 billion, while parent net debt dipped two percent to P146.1 billion.

Loan-to-value ratio, or the ratio of parent net debt (excluding the fixed-for-life perpetuals which have no maturity) to the total value of assets, stood at 11.2 percent. Parent net debt-to-equity ratio decreased eight basis points to 0.96 mainly due to the P13.1 billion preferred shares issuance. Parent average cost of debt increased to 5.37 percent from 4.48 percent in 2022, remaining comfortably below the five-year benchmark of 6.0 percent.

Read the full disclosures and press statements on the company websites or PSE Edge.

About the author

Knowledge Management (1)

AC Knowledge Management is responsible for enterprise content management, archives management, and the development of knowledge products and services in Ayala. KM produces books on corporate history and business developments and publishes the groupwide internal communications channel, The Ayala Way.