The Ayala Way Vol. 4 No. 110

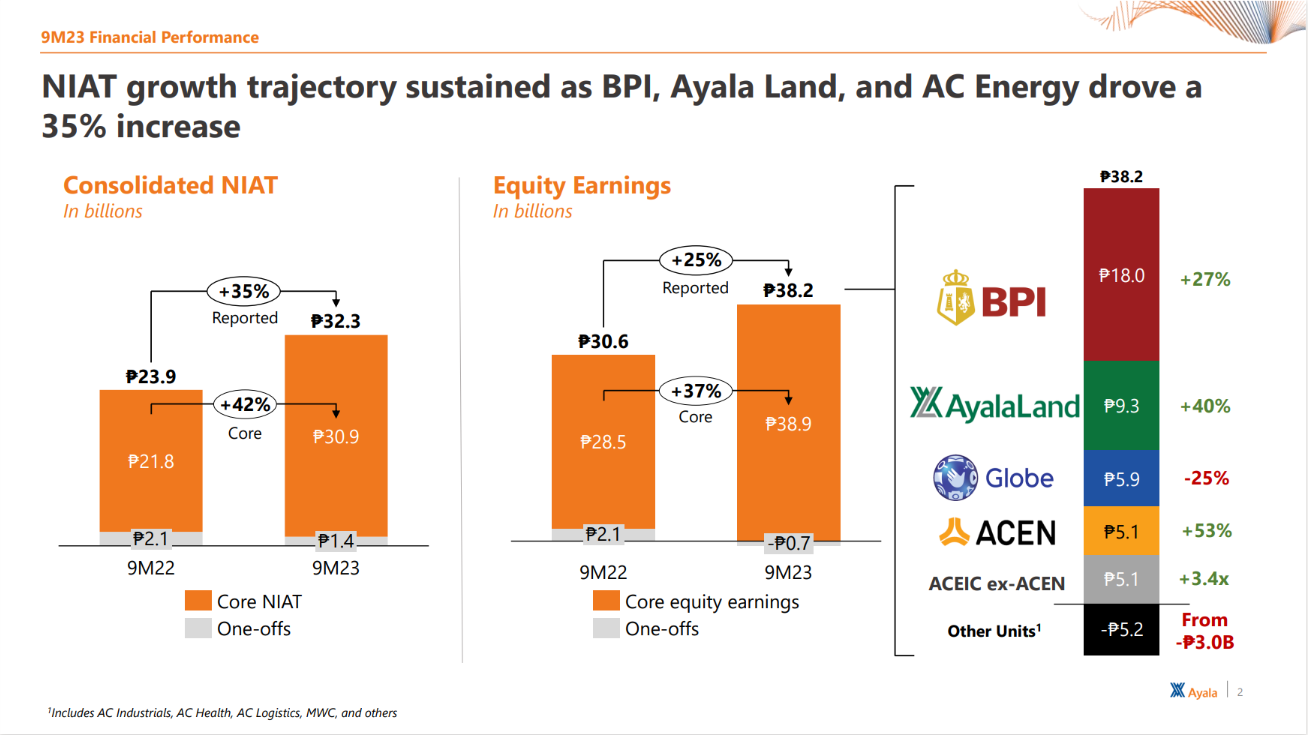

Ayala’s 9M23 Core Earnings Up 42% to P31B

Ayala Corporation’s core net income in the first nine months of 2023 grew by 42 percent year on year to P31 billion, anchored by strong results from BPI, Ayala Land, and ACEN. Ayala’s year-to-date core net income is already at par with its full-year 2019 net income. Accounting for all one-off items, including a P2.2 billion gain from the sale of the MCX toll road, Ayala posted P32.3 billion in net income in the first nine months of 2023, up by 35 percent versus the same period last year.

In line with its portfolio rationalization initiatives, Ayala has completed the following divestments: IMI’s sale of its 80 percent shareholdings in STI Enterprises Ltd. to Rcapital; AC Industrials’ sale of its 92.45 percent stake (held through its subsidiary, AC Industrials (Singapore) Pte. Ltd.) in MT Technologies GmbH to Callista Asset Management 18 GmbH; and Ayala’s sale of Manila Water common shares and participating preferred shares, with Ayala retaining an effective 23.5 percent voting stake and 22.5 percent economic stake in MWC.

Meanwhile, Ayala continues to scale its emerging businesses, AC Health and AC Logistics. Healthway Cancer Care Hospital, the country’s first dedicated cancer hospital, is scheduled to be inaugurated before yearend. AC Logistics’ cold storage facility with Glacier Megafridge in Cagayan de Oro, has reached 100 percent utilization; the company continues to integrate assets to eliminate redundancies, improve operational efficiency, and generate cost savings, while looking to capture more business from within the Ayala group.

Despite macroeconomic and geopolitical headwinds, our outlook remains intact as we look to end the year with profits exceeding pre-COVID levels. We continue to build on our solid 9M results and rationalize our portfolio wherever it makes sense to do so.

Cezar P. Consing

AC President and CEO

Balance Sheet Highlights

Consolidated cash ended at P82.9 billion from P77 billion as of end-2022, while consolidated net debt was P495.1 billion from P475.4 billion as of end-2022. Consolidated net debt-to-equity was at 0.73, well within the company’s covenant of 3.0. Parent level cash was P12.3 billion from P11.2 billion as of end-2022, while parent net debt was P144.5 billion from P149.3 billion as of end-2022.

Net debt-to-equity improved to 0.91 from 1.04 as of end-2022 due to the P13.1 billion preferred shares issuance, which was priced at a spread of 40 basis points over benchmark rate. Parent net-debt-to equity is expected to be at the end-2022 level with the redemption of P10.0 billion preferred shares in November 2023. Loan-to-value ratio, or the ratio of its parent net debt (excluding the fixed-for-life perpetuals which have no maturity) to the total value of its assets, remained at 11.1 percent.

Read the full disclosure and press statement on the company website or PSE Edge.

Ayala Triangle Gardens Tower 2

About the author

Knowledge Management (1)

AC Knowledge Management is responsible for enterprise content management, archives management, and the development of knowledge products and services in Ayala. KM produces books on corporate history and business developments and publishes the groupwide internal communications channel, The Ayala Way.