The Ayala Way Vol. 5 no. 84

Ayala Posts P24B in Core Earnings in 1H24

We are pleased with the sustained growth trajectory of our core earnings. We will continue to grow our quality businesses and explore initiatives to improve shareholder value.

CEZAR "BONG" CONSING

AC President and CEO

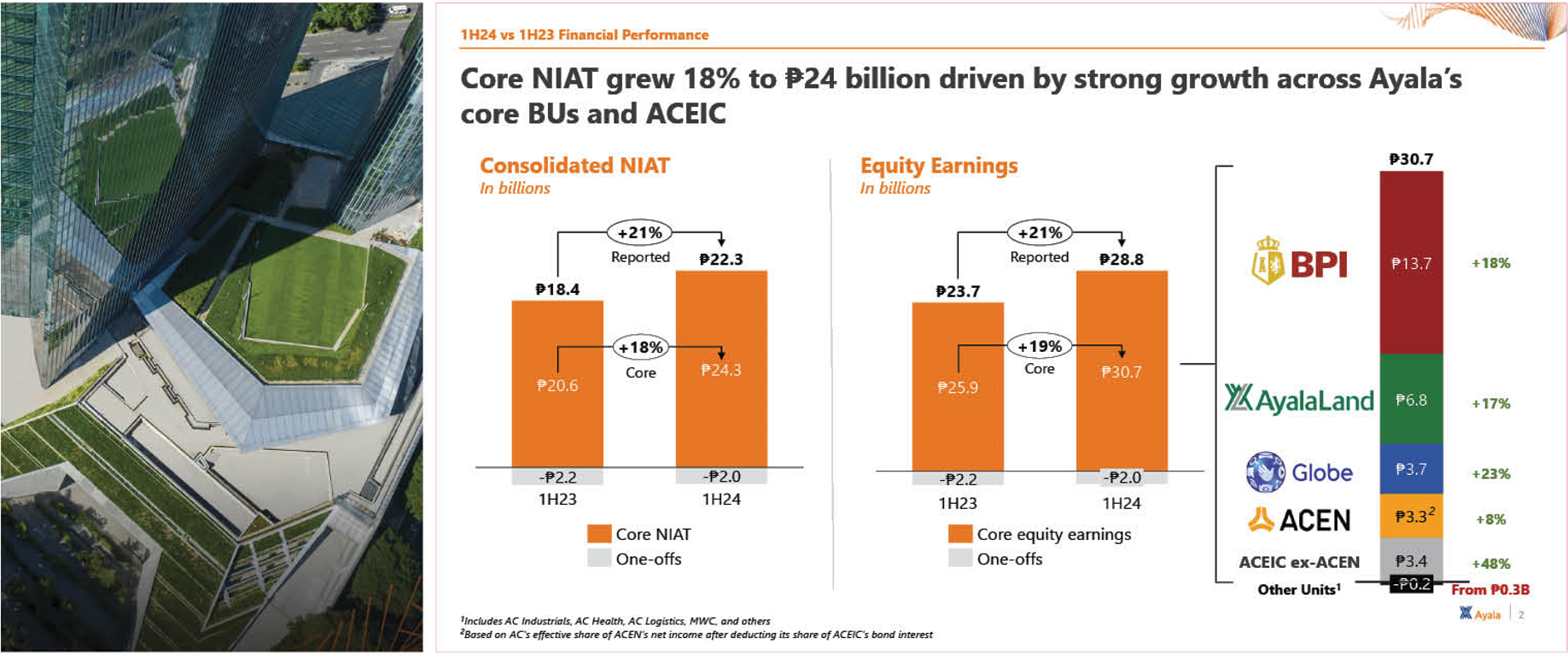

Ayala Corporation’s core net income, which excludes significant one-off items, grew 18 percent to P24.3 billion from stronger contributions from BPI, Ayala Land, Globe, and ACEN. Improved earnings from AC Energy & Infrastructure (ACEIC) also supported the company’s earnings performance. Including one-off items, Ayala’s net income increased 21 percent to P22.3 billion.

Ayala continues to maintain a strong balance sheet through active debt management and value realization initiatives. Consolidated cash amounted to P77.2 billion, while consolidated net debt increased six percent to P536.1 billion. Consolidated net debt-to-equity ratio increased one basis point to 0.76x, well within Ayala’s covenant of 3.0x.

Parent level cash was up 48 percent to P17.4 billion, and parent net debt stood at P146.4 billion. Loan-to-value ratio, or the ratio of its parent net debt (excluding the fixed-for-life perpetuals which have no maturity) to the total value of its assets, improved 30 basis points to 10.9 percent. Parent net debt-to-equity ratio improved five points to 0.91 due to the P12.8 billion in proceeds from the final tranche of the Manila Water divestment in May. Parent average cost of debt was at 5.4 percent which is below benchmark rates.

Ayala has a proposed offer and re-issuance of up to P15 billion Preferred “B” Shares with a base amount of P10 billion and an oversubscription option of up to P5 billion. The registration statement and application for listing, filed with the relevant regulatory bodies in July, are subject to review and compliance with their corresponding requirements.

About the author

Knowledge Management (1)

AC Knowledge Management is responsible for enterprise content management, archives management, and the development of knowledge products and services in Ayala. KM produces books on corporate history and business developments and publishes the groupwide internal communications channel, The Ayala Way.